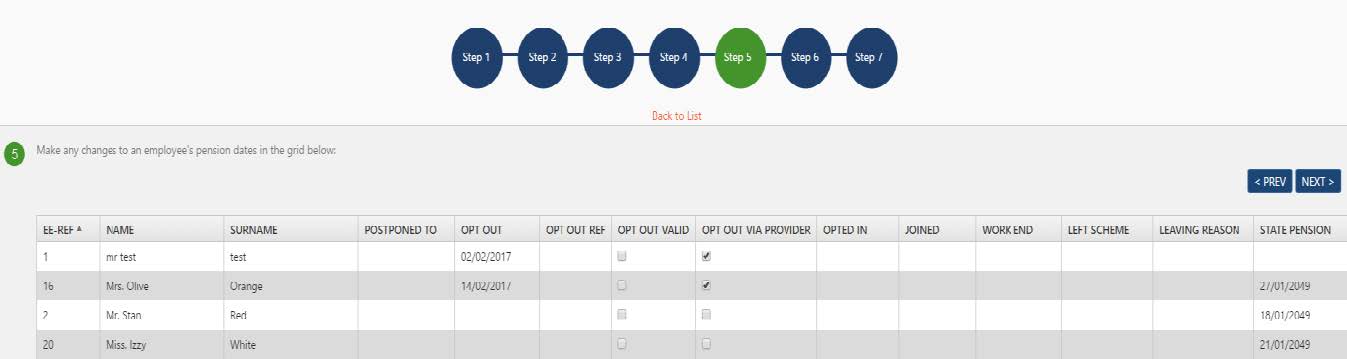

Next enter the date for any new action in respect of an employee, or check the values brought in from your Employee and Pay file or forward from the previous assessment. Amend where necessary. Details will be saved and re-presented in this grid for each subsequent assessment. (Hover your cursor over any column heading for a description of the details to be entered.)

These details can also be uploaded from the EE and Pay file – dates need to be populated in your file prior to upload at Step 2.

The details of fields are as follows:

| Field name | Description of details to be entered:

|

| POSTPONED TO | Note: you can set a global postponement rule at employer level for each of the occasions below that can allow you to postpone workers.

However, if you wish to override the automated date (or no date) that OE proposes based on your employer level choice, enter the postponed to date for the individual employee for a period of up to three months. Postponement can only be used for a worker on certain dates:

|

|

OPT OUT |

Date on which employee opted out. Enter a date (dd/mm/yyyy) on which an employee formally opts out. If the opt out date is <= 30 days from the

employee’s enrolment date then OptEnrol will treat this as a valid opt out,otherwise it will treat it as a left scheme event (ceased activemembership) – see also Opt Out Valid below. |

| OPT OUT REF | Opt Out Reference provided by Pension Provider (a NEST requirement) |

|

OPT OUTVALID |

Tick this box to override the 30-day check when providing an opt outdate. For example, use this when an employee has informed theemployer that they wish to opt-out within 30 days from enrolment, but this was not processed in OptEnrol in time. |

|

OPT OUT VIAPROVIDER |

Tick this box if the employee has opted-out directly with the pension provider. This will ensure OptEnrol maintains the correct state for theemployee and does not send an opt out notification to the pensionprovider. PensionSync users can retrieve direct opt outs using the‘GetWorkerInstructions’ link from the Pensions tab. |

|

OPTED IN |

Enter the date (dd/mm/yyyy) an employee formally requests to Opt In orJoin. If assessed as eligible or non-eligible OptEnrol will enrol them into aqualifying scheme (both employee and employer make contributions). Ifassessed as

entitled, OptEnrol will “join” them into a scheme where they paycontributions, but it need not be a qualifying scheme and the employerneed not make contributions. |

| JOINED | Ignore this column. Due for removal. |

| WORK END | Date employee ended employment |

| LEFT SCHEME | Date on which the employee chose to leave a scheme and not being avalid “Opt-Out”, or the date the employee’s scheme ceased to qualify asan auto enrolment scheme (in which case they may need to beimmediately re-enrolled into an AE scheme). |

| LEAVING REASON | “Scheme” – meaning that something about the scheme has changed tono longer qualify as a valid workplace pension. In this case theemployee will be immediately re-assessed and enrolled

“Employee” “Notice Given” |