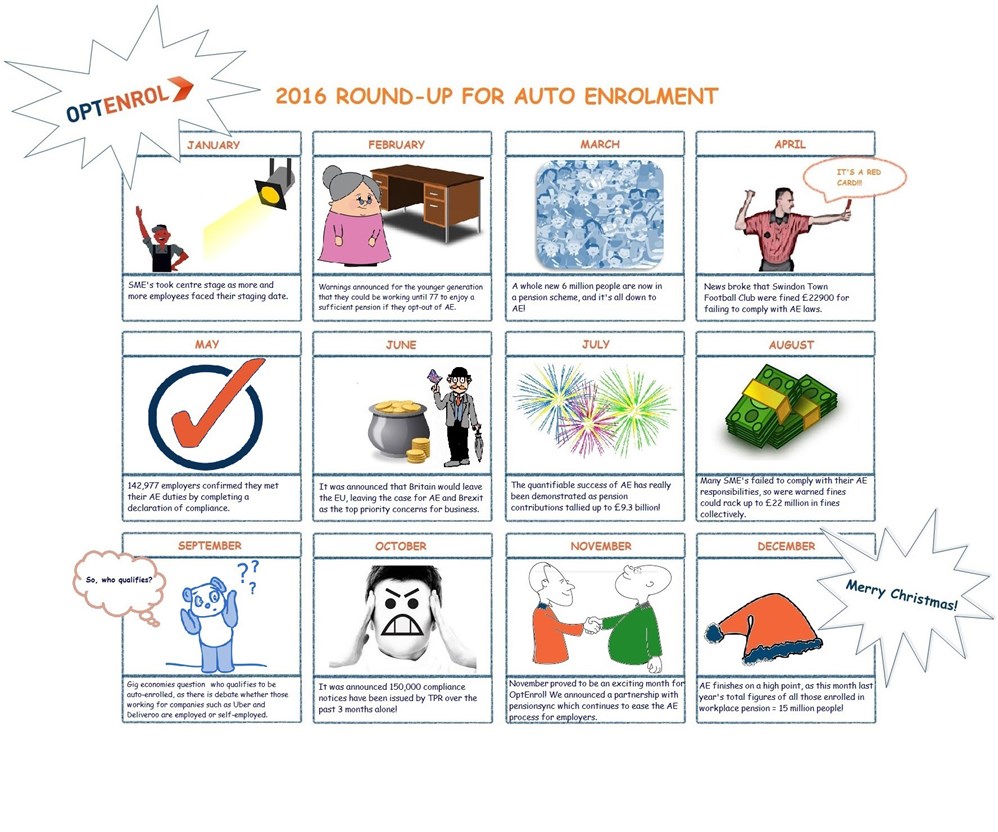

As we get older we look back at our youth with fondness, however spare a thought for Generation Z, those born after 1996, they have a lot on their plate.

Saving is difficult at the best of times and nowadays practically impossible for the millennials. For Generation Z, it’s just going to get worse! Let’s look at why…

There are more graduates than ever before and competition for graduate positions is tough. The Financial Times reported that between 2012 and 2016, there was a 40% increase in the number of applications for graduate positions. In the financial industry especially, competition is so fierce that JPMorgan hired only 2% of all graduates who applied!

Once you have fought off the competition and got yourself that dream job, or at least a job, there is the small matter of rent A quarter all graduates in the UK will end up in London within 6 months of completing their degree, where the average price to rent is £1508 per month. And this figure is not going to get smaller anytime soon, as Savills stated rent prices are expected to increase by 19% over the next five years.

With the average starting salary for a graduate ranging from £19,000-£22,000, saving for a deposit and becoming a home-owner before the age of 35 is near impossible. On top of that, there are student loans and tuition fees to pay back to push this prospect even further away.

This has resulted in a 25% increase since 1996 of those aged 20-34 living at home with their parents, in order to try to save money.

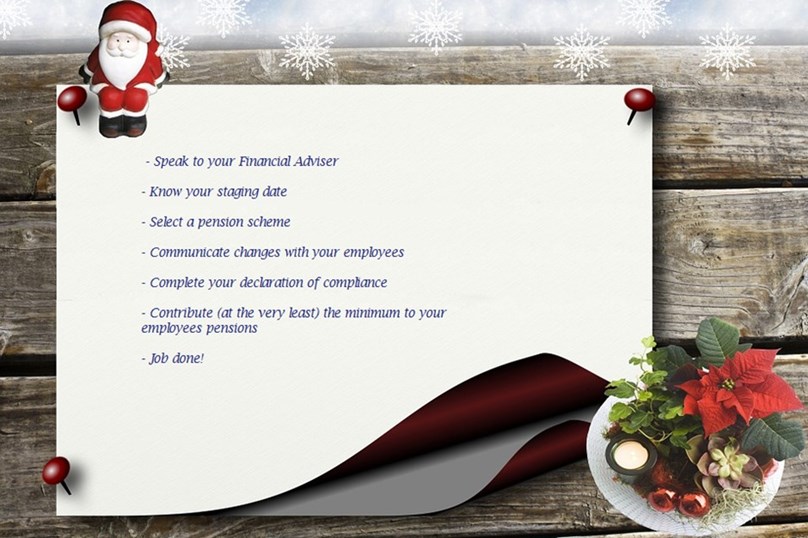

With rising rent prices and fierce competition to secure a graduate position at least auto enrolment ensures that their retirement is taken care of!

So for the rest of us let’s try and help them as much as we can. Mums, dust off their old bedroom, teachers make sure you give them all the tools they need to face the world and employers don’t be greedy. They are the future after all…