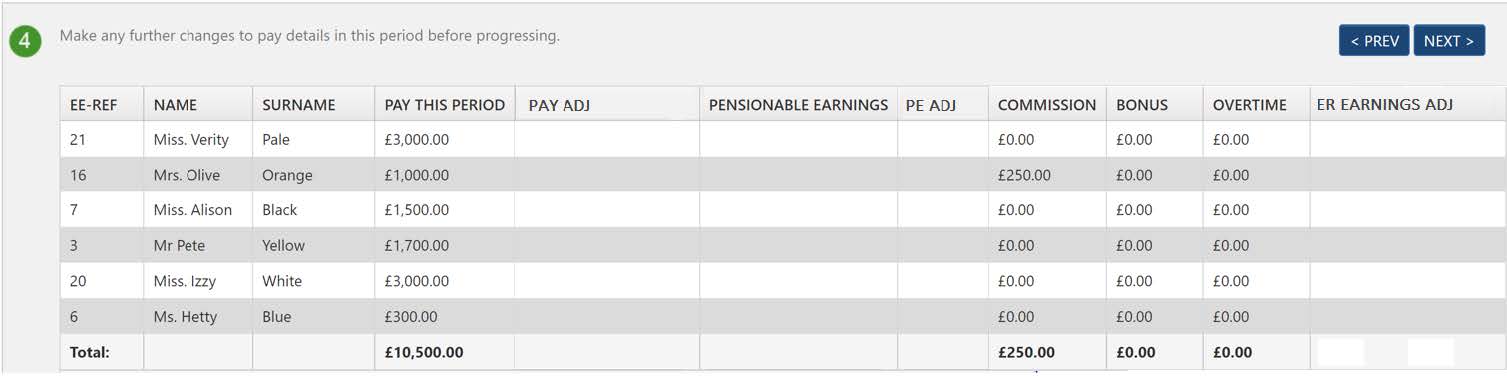

The imported employee and pay details for this PRP are shown in a grid for you to check and amend if necessary.

Manual amendments to any pay elements can be done at this step.

The details of fields are as follows:

| Field name | Description of details to be entered: | ||

|

PAY THISPERIOD |

The fixed pay for the employee this payroll period. It should includeall gross pay including any Statutory Maternity, Paternity, Adoptionor Sickness Pay, overtime, commission, and bonus. If your schemeis Pensionable Pay Set 1 or 2 any values in Commission, Bonus orOvertime will be deducted from the Pay This Period in calculatingthe contributions but no in assessing whether workers are eligible forauto enrolment.

If your pension scheme basis is Qualifying Earnings, OE will use the amount of the value from Pay This Period that falls within the lowerand upper limits of the QE band on which to calculate contributions. |

||

| (PAY ADJ)

Pay This PeriodAdjustment |

Gives any adjustment that is required to the Pay This Period thathas been extracted from payroll. This field should only be used asan override where the file has been extracted from payroll andthere are specific aspects of the employee’s pay that have notalready been included in the Pay This Period value. This value maybe negative.

Where the employee/pay template has been populated manually ienot by software, there should be no need to populate this field. |

||

| PENSIONABLEEARNINGS | You do not have to put a figure in this field but if you do OE will use the value for calculating contributions and will ignore anycommission, bonus, and overtime values. It will still use the Pay ThisPeriod value for assessing the worker status.

If you have no value in Pensionable Earnings and your pensionscheme basis is Pensionable Pay Set 1 or Set 2, any commission, bonus or overtime values below will be deducted from Pay ThisPeriod before contributions are calculated. |

||

|

(PE ADJ) Pensionable EarningsAdjustment |

Gives any adjustment that is required to the Pensionable Earningsthat has been extracted from payroll. This field should only be usedas an override where the file has been extracted from payroll andthere are specific aspects of the employee’s pensionable pay thathas not already been included in the Pensionable Earnings value.This value may be negative.

Where the employee/pay template has been populated manually,there should be no need to populate this field. |

||

| COMMISSION | The gross commission. Usually not needing to be populated. | ||

| BONUS | The gross bonus. Usually not needing to be populated. | ||

| OVERTIME | The gross overtime. Usually not needing to be populated. | ||

|

(ER EARNINGS ADJ) ER Earnings Adjustment |

This field allows the user to adjust the pensionable earnings to be used for the calculation of employercontributions, for example when an employee is on parental leave. Where the pension scheme in use is a qualifyingearnings scheme, this value will be added to the Pay This Period value for the calculation of employer contributions.Where the pension scheme in use is a pensionable earnings scheme, this value will be added to the PensionableEarnings value for the calculation of employer contributions. This adjustment will be made in addition to the Pay This Period and Pensionable Earnings Adjustments described inthe preceding fields. |